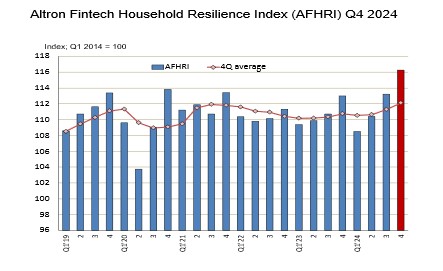

The results of the Altron FinTech Household Resilience Index (AFHRI) for the fourth quarter of 2024 confirm a modest improvement in the financial disposition of South African households, mainly due to three cuts of 25 basis points each in the repo rate between September 2024 and January 2025.

This led to the lowering of the prime overdraft rate from a record high of 11.75% to 11% currently.

The latest results of this index need to take cognisance of the spike in the indicators for long-term insurance surrenders and lump-sum pension withdrawals.

These have been influenced by the so-called two-pot retirement system, which commenced in the third quarter of 2024 and has led to a significant increase in retirement fund withdrawals - to the detriment of longer-term financial security.

Other indicators that have assisted the positive trend of the AFHRI include:

- Private sector employment has increased and is at a higher level than before Covid

- Real levels of labour remuneration in the private sector have increased, both on a quarter-on-quarter and year-on-years basis

- The higher value for unit trust assets (a proxy for the net asset value of companies listed on the JSE) should provide a boost to the levels of collateral required by households when applying for credit

Operation Vulindlela promises higher growth

The second phase of Operation Vulindlela (OV) was announced on 7 May, and it has set 30 key reforms to assist the quest for higher economic growth, especially in the energy, logistics and water sectors. Although the tasks related to improving South Africa’s decaying infrastructure are intimidating, it should be noted that the impact of the first phase of OV has been independently verified and include energy reforms that have generated more than 20,000 MW of independent renewable power.

Furthermore, the Bureau for Economic Research has modelled the new reforms and found that, if implemented, SA could target 3.5% growth by 2029.

Notable reforms that have now been announced include the restructuring of Transnet; the introduction of private sector participation (PSP) in ports and rail through a dedicated PSP Unit; and the implementation of a points-based system for critical skills visas and general work visas.

Tourism recovery on track

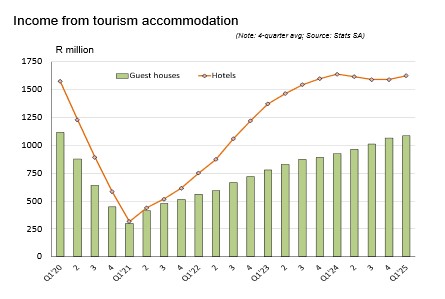

During the first quarter of 2025, tourist arrivals from overseas increased by 3.6%, compared to the same quarter last year – cementing the recovery from the disastrous effects of the Covid pandemic. The number of overseas tourist arrivals is now at 90% of the pre-Covid level (first quarter of 2019) and bodes well for a sector that is highly labour intensive. The top-five source countries for tourists are: the UK; the USA; Germany; France; and the Netherlands, with Australia bubbling under in position no 6.

An outstanding feature of the latest data on accommodation income in the tourism sector is the stellar performance of South Africa hotels, which continue to recover from the sharp decline induced by the Covid lockdowns. During January & February 2025, the accommodation income from hotels amounted to R3.74 billion, which was 9.8% higher than a year ago.

Lower inflation may result in further interest rate cuts

The consumer price index (CPI) resumed a declining trend in March, mainly due to producer price inflation (PPI) remaining at historic lows. In March, the CPI recorded an annualised rate of increase of 2.7%, whilst the PPI also declined from the February figure and is now at a level of 0.5% - exactly the same as its average rate of increase over the past seven months. The fact that both of these two benchmarks of inflation are below the Reserve Bank’s target for inflation (3% to 6%) could lead to a repo rate cut in May.