Silver Linings by Dr Roelof Botha

Lekker Goeie Nuus, Soos Gewoonlik!

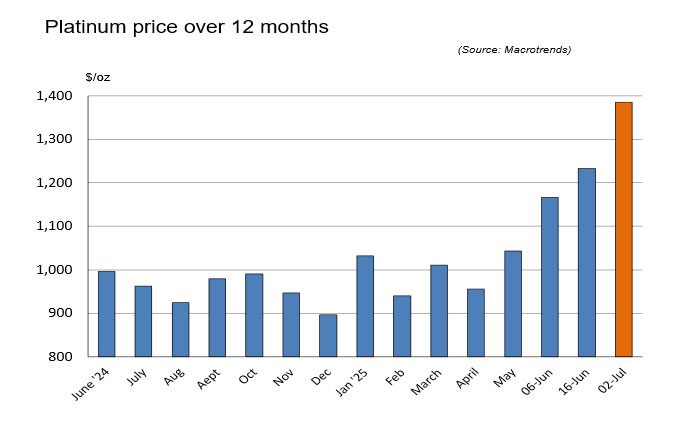

Following a fairly subdued first five months of the year, the prices of platinum group metals (PGMs) suddenly came to light in June. Between 2 January and 2 July, the increases in the prices of platinum, palladium, rhodium and ruthenium amounted to 49%, 30%, 20% and 63%, respectively. South Africa is by far the world’s largest supplier of PGMs, which are critically important for the global energy transition (especially in the hydrogen economy).

The World Platinum Investment Council forecasts a further supply shortfall of almost 1 million ounces this year, mainly due to a 4% drop in global output. Combined with platinum’s relatively more attractive affordability versus gold, the prospects for further price gains are favourable. This promises to be exceptionally good news for the South African platinum mining industry.

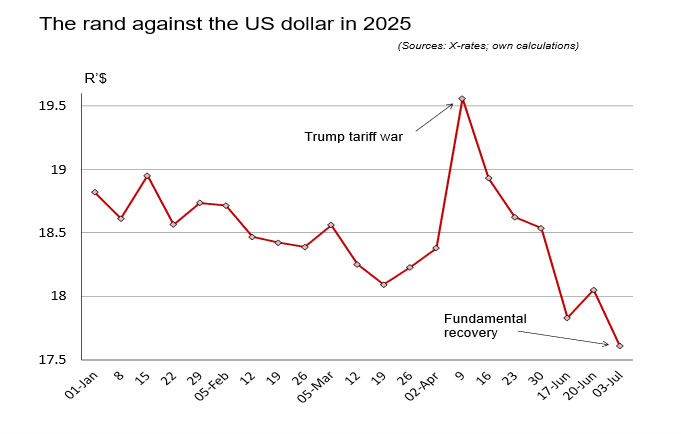

Rand continues strengthening

During June, most key currencies of the advanced economies (AEs) and the emerging market economies (EMEs) continued to benefit from a weaker US dollar. These gains were fairly modest, except for the Brazilian real, the Polish zloty and the Euro, with South Africa’s currency also amongst the best performers. Since the beginning of the year, the rand has strengthened by almost 7% against the greenback. The US dollar index has slumped to its lowest level in three years, with analysts grappling with the question of whether this could be a structural weakness or merely a short-term glitch.

According to a note from Standard Chartered Bank, a temporary rally could occur in the event of fiscal, monetary or global trade policies changing course. The note contends that most of the dollar’s decline since May is explained by tamer inflation readings and that the narrative of unrelenting structural selling of the dollar is inaccurate. In any event, a weaker dollar may be just what the US has been hoping for, due to its persistently high trade deficit.

The dollar’s recent weakness has certainly been influenced by improved risk appetite across global markets, which has manifested itself in the rapid resurgence of stock markets, as the so-called trade war turned out to be less disruptive and subject to bilateral deals aimed at finding a degree of middle ground between the demands of the US and the response by the most affected countries and regions.

Transnet privatisation on track

The quest to revitalise South Africa’s ailing logistics sector through private sector participation has gained significant traction, with the Department of Transport’s request for information generating substantial industry interest and setting the stage for major reforms. A total of 162 formal responses were received across three critical freight corridors, namely:

- The iron ore and manganese corridor (Northern Cape to Saldanha and Nelson Mandela Bay)

- The coal and chrome corridor (Limpopo and Mpumalanga to Richards Bay)

- The container and automotive intermodal corridor (Gauteng to Durban, the Eastern Cape and Western Cape).

Progress with logistics at SA’s ports

Despite intermittent problems with equipment breakdowns, operational challenges and adverse weather at most of South Africa’s ports, an annual record average of 13 893 shipping containers was handled daily during the third week of June, the majority of which were destined for exports. Further improvements in efficiency at the country’s ports should contribute to higher levels of international trade activity, with a further improvement of South Africa’s trade balance firmly on the cards.